The venture capital scene has been thrown into a state of flux with a startling 80% decrease in funds raised by startups from Q1 2022 to Q1 2023. Coinciding with this, we witnessed a 45% decline in venture deal counts in the same timeframe. This marks Q1 2023 as the most sluggish quarter in terms of capital raised and deal count since 2017.

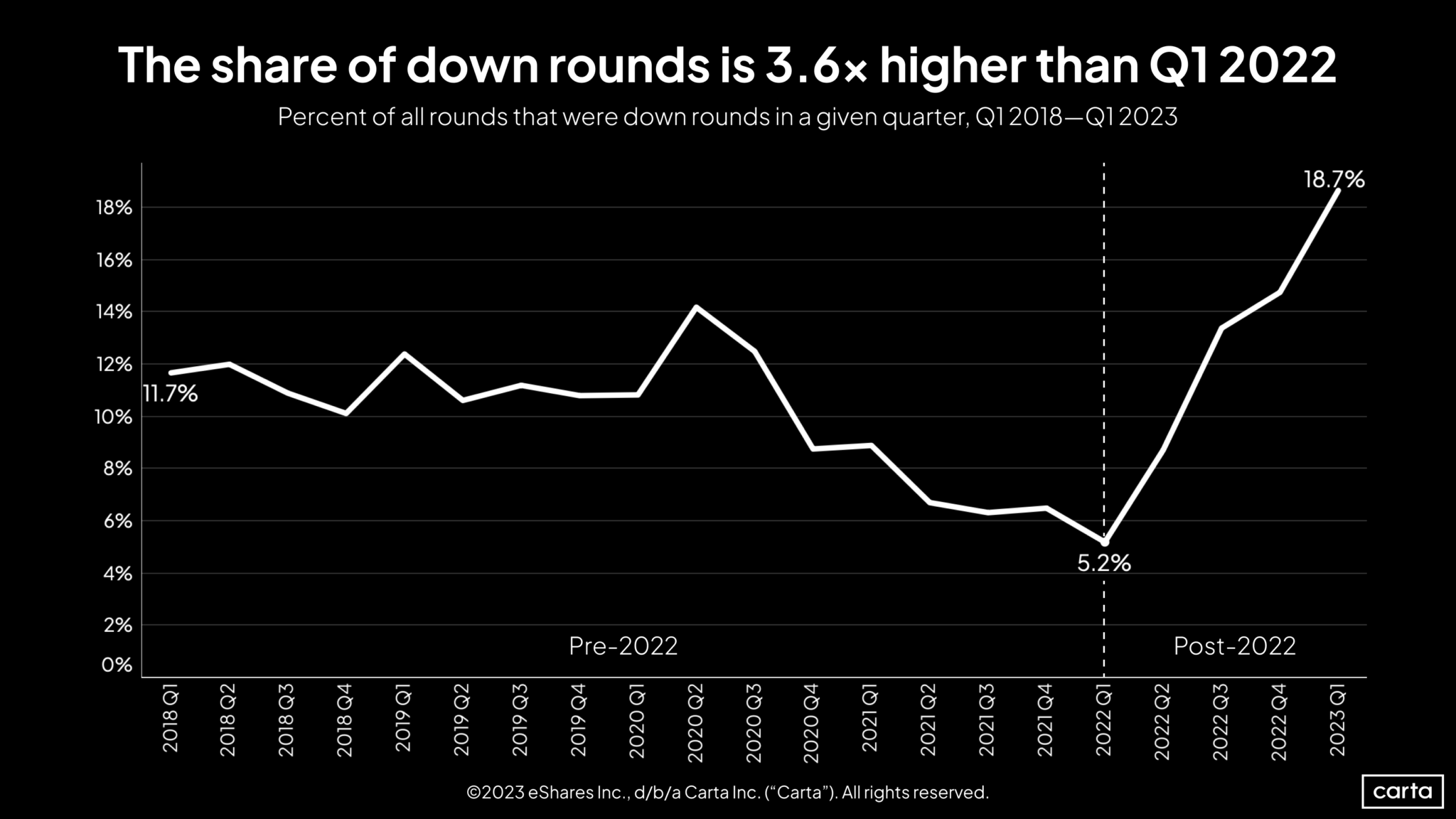

A notable trend that caught our attention was the surge in “down rounds”. Almost 20% of all venture investments in Q1 constituted down rounds, marking the highest rate since 2018. A comparison with the previous year, where a mere 5% of venture deals resulted in diminished valuations, paints a stark picture of the current investment climate. As a consequence of median valuations plummeting significantly from their previous peaks, numerous companies vying for a valuation increment are now swimming against the tide.

Amidst these changing tides, an interesting development has been the growing preference for bridge rounds. Companies at various stages, from Series A to Series C, are finding bridge rounds to be a more appealing alternative. The data underpins this shift, with at least 40% of all investments in Series A and Series B companies in Q1 being bridge rounds – the highest figures observed in the 2020s.

However, the startup landscape hasn’t been all doom and gloom. A silver lining is the resurgence of startup M&A activities. Q1 saw a 20% hike in the number of venture-backed companies that were acquired or merged compared to Q4 2022. Moreover, a significant 57% of these M&A deals were valued at $10 million or less. This suggests that, in the face of a daunting environment for raising new venture capital, some smaller startups are electing to take the exit route instead.

In summary, Q1 2023 has been a period of significant shift in the venture capital landscape. The dynamics are changing, and startups need to adapt and evolve in response to these new realities. The coming quarters will undoubtedly be crucial in shaping the future of venture capital and startup financing.

Thanks to Peter Walker from carta for these insights https://carta.com/blog/state-of-private-markets-q1-2023/